Introduction

Healthcare demands are no longer limited to national borders in today’s linked world. If you travel a lot, live abroad, or work from home, it’s important to be able to get good medical care anywhere in the globe. This is where global health insurance comes in. Global health insurance makes sure you can get medical care no matter where you are. This is different from standard health insurance, which usually only covers one country or region. This kind of insurance gives people and families peace of mind that they will always have access to healthcare, from regular check-ups to emergency care.

As more individuals relocate from one country to another for employment, school, or fun, global health insurance has become more and more important. Travelers and expatriates frequently encounter unforeseen medical costs, and local healthcare systems may be expensive or unavailable. Global health insurance protects you by paying for hospital stays, operations, outpatient care, prescription drugs, and occasionally even evacuation in case of an emergency. To choose the correct plan, you need to know things like network coverage, premiums, exclusions, and the ability to get care in more than one country.

What does Global Health Insurance mean?

Global health insurance is a sort of medical coverage that covers all types of healthcare services, no matter where you live. Global health insurance is different from domestic health insurance policies since it covers people in more than one country. This includes care that stops problems before they happen, testing to find out what’s wrong, visits to specialists, surgeries, hospital stays, maternity care, and medical evacuations in case of an emergency.

One of the best things about global health insurance is that it can be changed to fit your needs. Policies can be made to fit your needs, whether you are traveling alone, with your family, or as an expatriate. Some plans also include extra benefits like telemedicine consultations, wellness programs, and coverage for illnesses that already exist. Policyholders can choose healthcare providers anywhere in the world, which means they can get top-quality care without having to worry about expensive medical bills.

Advantages of Global Health Insurance

Choosing global health insurance has many benefits. First and foremost, it gives policyholders access to healthcare services in many countries, so they can travel or live abroad without worrying about medical crises. This type of insurance protects your finances by paying for big medical bills that you would not be able to afford otherwise.

Another benefit is that there are international medical networks. Many global health insurance companies work with well-known hospitals, clinics, and specialists all around the world. This network lets you pick the best doctor or hospital for your needs, which guarantees good care. Also, global health insurance usually covers preventive treatment like immunizations and health screenings, which are very important for staying healthy in the long run.

Finally, some plans come with extra benefits including medical evacuation, repatriation, and help with travel. During emergencies, these qualities can save lives, especially in places where medical care isn’t very good. With global health insurance, you can be sure that you can get expert medical treatment no matter where you are.

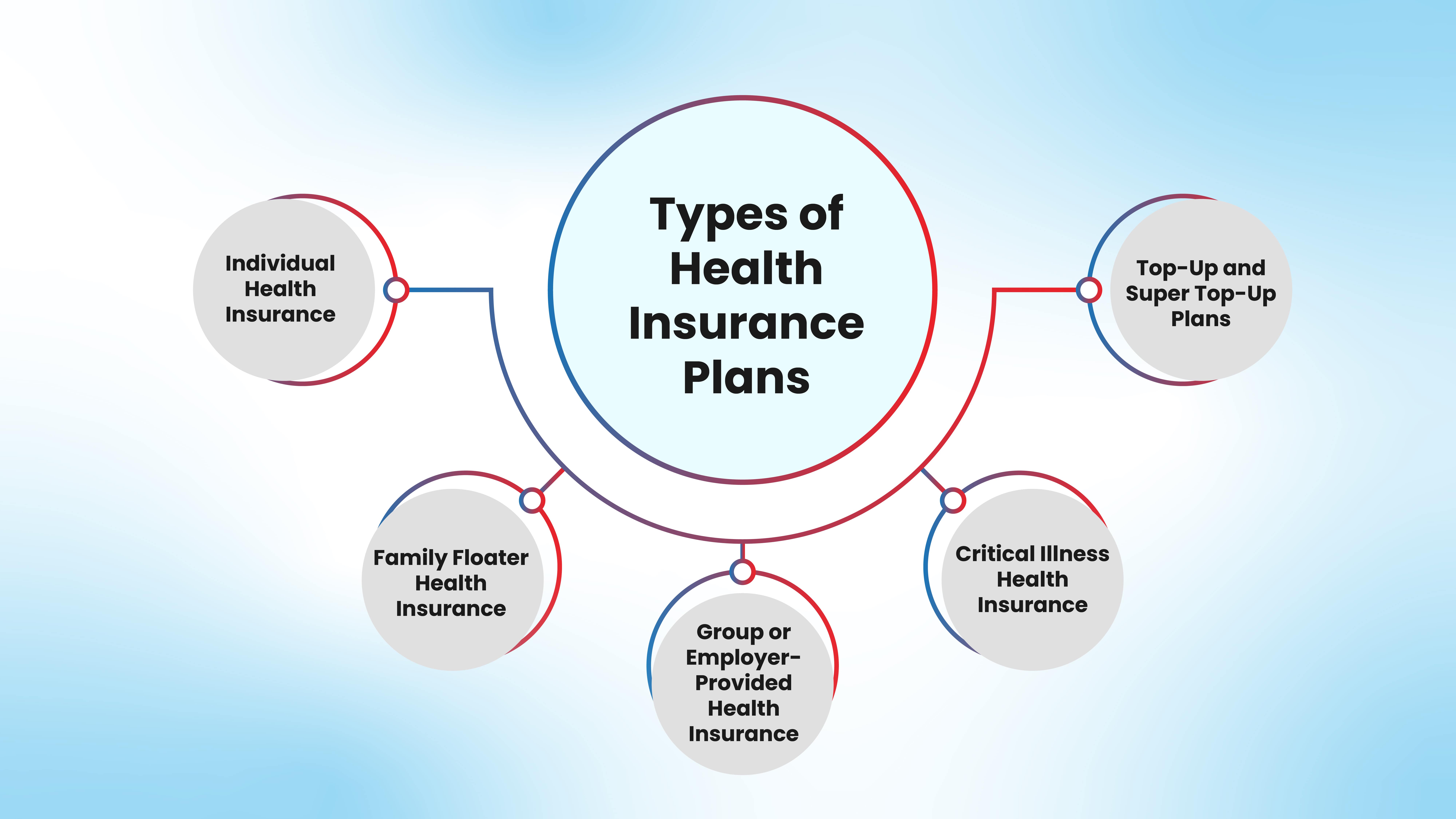

Different kinds of global health insurance plans

There are several types of global health insurance policies, each one designed for a certain purpose. It’s important to know what kinds of plans are out there in order to make a smart choice.

- Comprehensive Plans: These provide the broadest coverage, including hospitalization, outpatient care, maternity, dental, and sometimes even mental health services. Comprehensive plans are ideal for expatriates and frequent travelers seeking full-spectrum healthcare coverage.

- Travel Health Insurance: Focused on short-term coverage, travel health insurance is suitable for tourists or business travelers. It typically covers emergency medical treatment, hospitalization, and evacuation but may not include routine healthcare services.

- Expatriate Health Insurance: Specifically designed for individuals living abroad, these plans often include both inpatient and outpatient care, chronic disease management, and maternity coverage. Expatriate insurance ensures continuity of care, even if you move from one country to another.

- Specialized Plans: Some insurers offer specialized global health insurance policies catering to specific groups such as students, seniors, or high-risk travelers. These plans may offer targeted benefits like vaccinations, mental health support, or coverage for pre-existing conditions.

The type of global health insurance you need depends on how often you travel, your medical needs, your budget, and how much coverage you need.

Things to Look for in Global Health Insurance

When choose a global health insurance plan, some elements are very important to make sure you have full coverage. First, check to see if you have access to an international network. This will let you go to well-known hospitals and clinics around the world. A wide network makes sure that you have many choices for medical treatment.

Next, look at the limits on your coverage for hospital stays, surgeries, and outpatient treatment. Having enough coverage means you won’t have to pay for unforeseen medical expenditures. Also, think about if the coverage covers emergency medical evacuation and getting you back home. These attributes are quite important if you are in a place with little medical facilities or if you need treatment in another country.

Coverage for pre-existing diseases, maternity care, and preventive services are also key elements. Some policies also help with mental health, which is becoming more and more important for overall health. Also, seek for insurance terms that are flexible so you can tailor the plan to your needs, such choosing deductibles, co-payments, and optional add-ons.

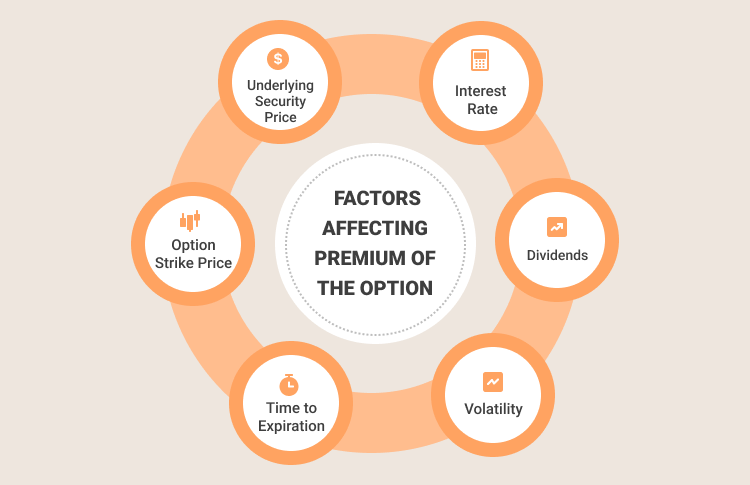

Knowing about costs and premiums

There are several things that affect the cost of global health insurance, such as your age, health, coverage restrictions, where you live, and the type of plan you choose. Comprehensive policies are normally more expensive but cover more things. Short-term travel insurance is usually cheaper.

The level of benefits, network access, and optional extras like dental, vision, or maternity coverage all affect the cost of premiums. Many insurance companies also think about the dangers that come with your job and lifestyle. For instance, someone who often travels to remote or dangerous places may have to pay more for insurance since they are more likely to need emergency medical care.

It’s crucial to look at more than one plan, know what’s covered and what’s not, and pick a policy that offers good protection at a reasonable price. Keep in mind that the cheapest plan may not always give you enough coverage, and unexpected medical bills can be far higher than the savings on premiums.

How to Pick the Best Global Health Insurance

You need to think about a lot of things before you can choose the best global health insurance. First, think about how often you travel, what kind of health care you require, and how much money you have. Think about the nations you will visit or live in and make sure the strategy covers those places well.

After that, carefully read the policy’s inclusions and exclusions, especially for emergency medical evacuation, pre-existing conditions, maternity, and chronic disease management. Check out the network of hospitals and specialists to be sure you can get good care.

Also, look at the insurer’s reputation, how they handle claims, and how well they help customers. Trustworthy suppliers help you right away and have clear policies. Reading reviews and asking other expats or travelers for advice can provide you useful information. Finally, pick a policy with terms that can be changed as your situation changes.

Things People Get Wrong About Global Health Insurance

A lot of people don’t know much about global health insurance. A popular myth is that only rich people or people who travel a lot may use it. In actuality, many people can get global health insurance, such as students, people who work from home, and families that live overseas.

Another wrong idea is that local health insurance is enough. Local plans may cover basic treatment, but they usually don’t cover treatment outside of the country. This means that travelers may have to pay a lot for medical care while they’re away. Some people think that worldwide health insurance is only needed in case of an emergency, but it also covers normal care, preventive services, and chronic illnesses, which are all important for staying healthy in the long run.

People can make better choices and see the value of having full global health coverage if they understand these myths.

Health Insurance for Families Around the World

Global health insurance is quite helpful for families who live or travel a lot outside of the U.S. Family plans usually cover both parents and children under one policy. This makes it easier to manage and makes sure that everyone gets the treatment they need.

Family plans usually cover things like pediatric care, vaccines, maternity care, and managing chronic diseases in kids. Some insurance also include wellness programs, mental health support, and telemedicine services, which are especially helpful for families with young kids or older members.

When you choose a family-friendly global health insurance plan, you can relax knowing that everyone in your family can get high-quality medical care no matter where they are.

How to File Claims with Global Health Insurance

If you know how to do it, filing claims with global health insurance can be easy. Most insurance companies let you choose from a number of options, such as submitting claims online, through a mobile app, or by email. You will usually need to send in medical records, bills, and information about your insurance.

Some plans let the insurer pay the hospital directly, which lowers the amount of money you have to spend out of your own pocket. To make the process go smoothly, you need to know how to file a claim, what papers you need, and when you may expect to get your money back. To avoid delays, always keep track of all of your medical treatments and invoices.

If you have reliable customer service and clear claims processes, the process will be easy for you, so you can focus on getting better instead of filling out forms.

Conclusion

Global health insurance is more than just a safety net; it’s a whole solution for people, families, and expats who want to feel protected while living or traveling abroad. It makes sure that healthcare is never a problem by giving people access to good medical care wherever in the world, including for emergencies, preventive care, chronic diseases, and even pregnancy.

You need to think carefully about coverage options, pricing, network access, and the reputation of the insurer before choosing a plan. Global health insurance protects your health and finances, whether you travel a lot, work remotely, or move to another country. With the correct coverage and good planning, you may travel the world with peace of mind, knowing that you can always get expert medical treatment.

Read More:- Celine Dion’s Epic Love Anthem: It’s All Coming Back to Me Now